Scientology’s UK bank NatWest, which was fined £264 million in 2021 for failing to prevent money laundering, has issued a statement after allegations emerged of the Church engaging in widespread credit card fraud.

Banks in Britain are currently in the spotlight following reports of a widespread movement to blacklist public and political figures deemed ‘high risk customers’. Dubbed the ‘debanking scandal’ it has triggered an investigation into banking procedures, with Prime Minister Rishi Sunak confirming the government was tightening rules around account closures.

The allegations were brought to light following the termination of politician Nigel Farage‘s account with Coutts, part of the NatWest Group, after the bank’s Wealth Reputitional Risk Committee determined there were “significant reputitional risks of being associated with him”.

In the wake of the scandal, NatWest Group’s CEO Dame Alison Rose was forced to step down and issue an apology to Mr. Farage, stating “decisions to close an account are not taken lightly and involve a number of factors including commercial viability, reputational considerations, and legal and regulatory requirements.”

The Church of Scientology, which is widely regarded as the world’s most controversial religion, banks with NatWest in the United Kingdom and despite its policy on “reputational considerations” has not seen its accounts closed and continues to use its services to engage in questionable financial activities.

In 2021, the bank admitted failures in its anti-laundering measures after it was fined £264.7 million ($330 million USD) for accepting deposits of laundered money, with the Financial Conduct Authority (FCA) stating NatWest did not properly investigate “numerous warnings” generated by its system designed to flag suspicious activity.

In 1999, Scientology was rejected tax-exemption after the Charity Commission concluded it did not exist for the “public benefit”. It currently operates in the UK through an Australian-registered charity called COSRECI (Church of Scientology Religious Education College, Inc), which reported a turnover of £13.7 million ($17.1 million USD) and debts of over £55.5 million ($69.2 million USD) in 2022.

COSRECI’s filings with Companies House show a number of loans and mortgages to Scientology have been granted by NatWest and in 2006 ahead of the opening of its London Org on 146 Queen Victoria Street, celebrity Scientologist John Travolta was pictured presenting the City of London Police with two cheques for £5,000 bearing the NatWest logo under their ‘Safe Pointing’ policy.

‘Chase Wave’ and American Express credit card fraud

In 2021, journalist Tony Ortega revealed that Scientology had been blacklisted by Chase Bank in the United States following allegations of fraud known as the ‘Chase Wave’. He explained the Church had “developed a specific high-pressure routine to encourage members to rack up huge credit card bills, which not only left them under crushing debt, but also created a backlash from the credit card company.”

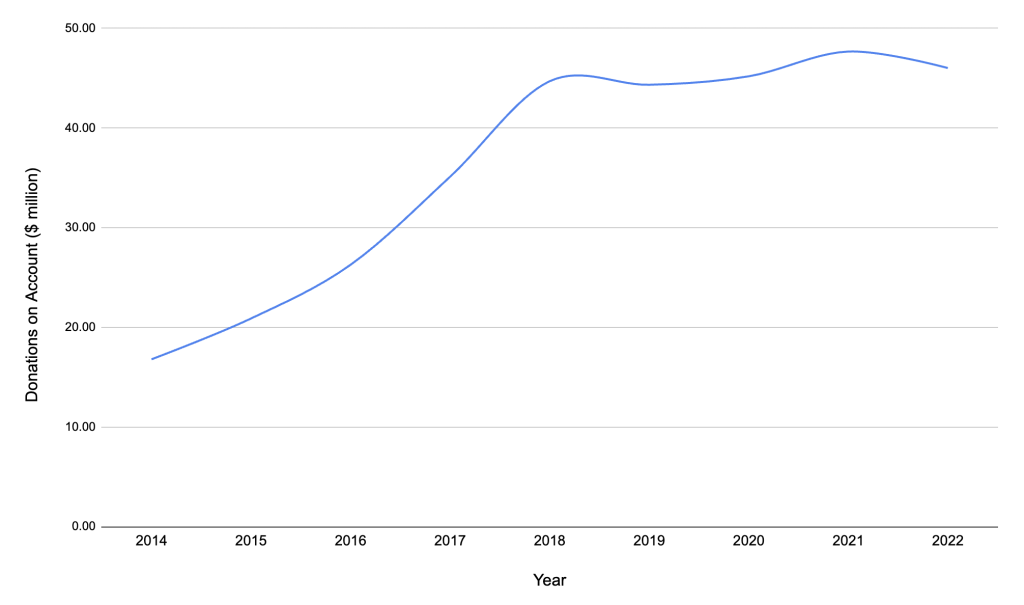

Scientology’s UK accounts show a dramatic increase in revenue throughout the time the Chase Wave was ongoing, with income doubling between 2014 and 2018. Perhaps more worryingly, it’s reported ‘donations on account’ have tripled over the last decade, suggesting the Church may have engaged in a campaign to encourage its members to donate for services, despite being unable to deliver them.

Allegations of fraud are nothing new for Scientology. In the 1990s, American Express conducted an internal review that resulted in the termination of payments to the church. In a public post on an ex-Scientology forum, Karen De La Carriere, who was married to Scientology’s President Heber Jentzsch, explained “In the early 1990s, the regges (salespeople) were out of control. They actually talked numerous people into purchasing their “PATRON” status (in those days $40,000), putting it onto an AMEX card and then not paying and declaring bankruptcy to get off the hook.”

The Church’s headquarters in Florida and it’s Los Angeles Org had the salespeople make unauthorised charges on parishioners’ cards, she claims, leading to American Express suspending service.

Reputational Risk and ongoing monitoring

Scientology clearly presents a reputational risk to its banking providers and evidence exists of potentially fraudulent activities both abroad and in the UK. In light of these considerations, we reached out to the Church’s bank for a statement asking what safeguarding procedures are in place and whether Scientology’s custom is being reviewed as part of the investigation into the debanking scandal.

In response, a Natwest spokesman said

“NatWest provides banking services to a wide range of customers from across our communities. Both freedom of expression and access to banking are fundamental to our society. It is not our policy to close accounts on the basis of legally held religious or personal views.

We cannot discuss specifics about customer accounts without their consent for confidentiality reasons.”

Natwest Statement on the Church of Scientology, September 12th 2023

The bank reassured Scientology Business they constantly monitor their customers’ financial activities and if illegal financial activity is suspected, it will take action to protect them and the public. Despite this, Natwest was fined in 2021 for failures in its anti-money laundering measures and raises the question: has an internal investigation taken place into Scientology’s financial activities in the UK, and how can NatWest deem the “reputational risk” of politician Nigel Farage greater than the world’s most controversial religion, Scientology?